Giving You the

Peace of Mind

You Deserve

Giving You the

Peace of Mind

You Deserve

We help you achieve your financial goals through tailored

tax planning, strategy, and advisory.

We help you achieve your financial goals through tailored tax planning, strategy, and advisory.

Subscribe to the Distinct Newsletter

Subscribe to the Distinct Newsletter

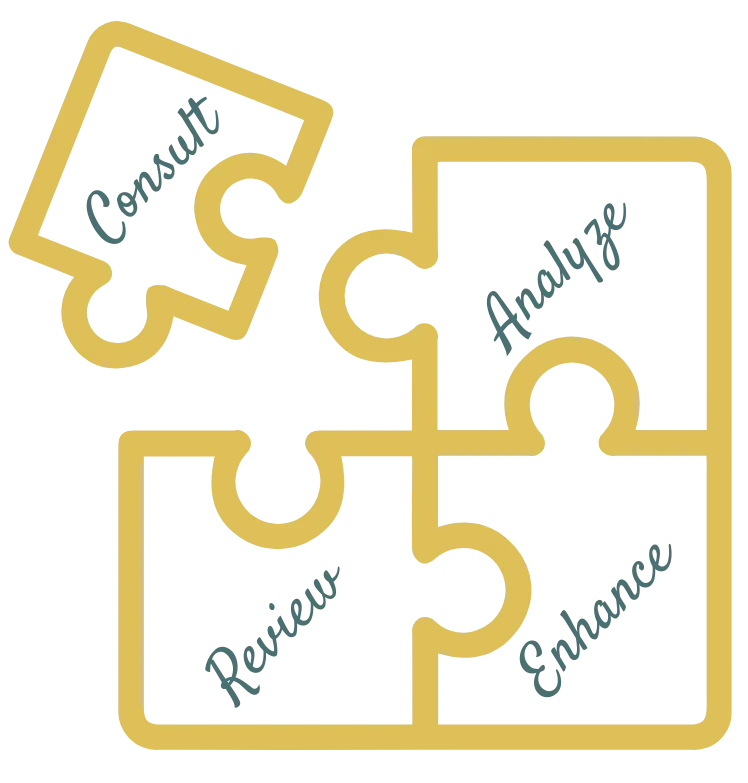

TRUST THE PROCESS

TRUST THE PROCESS

We have a proven four-phase approach that sets us apart.

By understanding your goals, analyzing your past financial data, and reviewing your tax transformation journey, we provide you with a comprehensive and customized tax strategy plan.

With clear action steps and expert recommendations, we empower you to take control of your tax situation and unlock potential savings, ensuring your financial success.

We have a proven four-phase approach that sets us apart.

By understanding your goals, analyzing your past financial data, and reviewing your tax transformation journey, we provide you with a comprehensive and customized tax strategy plan.

With clear action steps and expert recommendations, we empower you to take control of your tax situation and unlock potential savings, ensuring your financial success.

We’re here to transform your tax circumstance!

We’re here to transform your tax circumstance!

WHAT OUR CLIENTS ARE SAYING

WHAT OUR CLIENTS ARE SAYING

7 REASONS WHY DISTINCT

7 REASONS WHY DISTINCT

High tax burdens and complex tax regulations.

High tax burdens and complex tax regulations.

Cash flow constraints from unexpected tax obligations or inefficient tax management.

Cash flow constraints from unexpected tax obligations or inefficient tax management.

Navigating significant business changes like restructuring or succession planning.

Navigating significant business changes like restructuring or succession planning.

Missed opportunities for tax savings and incentives.

Missed opportunities for tax savings and incentives.

Compliance concerns and the risk of penalties or audits.

Aligning financial and tax strategies for personal and business goals, such as retirement or estate planning.

Planning for business expansion, mergers, or acquisitions with tax implications.

Compliance concerns and the risk of penalties or audits.

Aligning financial and tax strategies for personal and business goals, such as retirement or estate planning.

Planning for business expansion, mergers, or acquisitions with tax implications.

SOLUTIONS WE OFFER

SOLUTIONS

WE OFFER

Strategic

Tax Planning

Strategic

Tax Planning

Knowledge-based tax planning and projections provide financial advantages for all of our successful business and personal clients at Distinct Tax Consulting Group. Tax decisions and tax planning affect many long and short-term decisions that you make as a business owner.

LEARN MORE

SCOPE OF WORK

Tax Notice Response (Up to 2 included)

Reasonable Compensation Analysis

Quarterly Fixed Asset Depreciation

Quarterly QuickBooks Review

Tax Reduction Plan

Tax Projection

Tax Preparation (1 business and 1 Individual)

Tax Account Monitoring Quarterly Tax Deadline Reminders

Unlimited Email, Text, 15 & 30 Chat Support

Comprehensive Tax Compliance

Comprehensive Tax Compliance

Tax laws are changing all the time and it’s important that you get up-to-date, professional tax information firsthand from a professional team like Distinct Tax Consulting Group. DTCG strives to provide the expert information and assistance you need by pointing out the opportunities in tax law that will most benefit your specific situation.

LEARN MORE

FORMS/ SCHEDULES

1040-Individual Income Tax Return

State Income Tax Returns

1040X(Individual Amended Income Tax Return)

SCHEDULE A(Itemized Deductions)

Interest & Ordinary Dividends

SCHEDULE C/E (Profit or Loss From Business/Rental)

Schedule D (Capital Gain & Losses)

Form 1065-US Return of Partnership Income

Form 1120-Corporate Income Tax Return

Form 1120S-S Income Tax Return for an S Corporation

1065/1120/1120s Amended tax return

1041 Estate/Trust Return 990/990-PF Non Profit Return

990-N Non Profit Return Refund Transfer Fee

Re-Run Tax Return after return is complete Fee

Form 4868-6-Month Extension

IRS Transcripts (PER PULL)

Tax Notices (PER NOTICE)

Tax Audits

Hourly Consultations

Proactive Tax Maintenance

Proactive Tax

Maintenance

At DTCG, our highly trained and experienced staff have the ability to keep track of your important business records with accuracy and great attention to detail. You’ll have the timely information you need to make important decisions at your fingertips.

Knowledge-based tax planning and projections provide financial advantages for all of our successful business and personal clients at Distinct Tax Consulting Group. Tax decisions and tax planning affect many long and short-term decisions that you make as a business owner.

Tax laws are changing all the time and it’s important that you get up-to-date, professional tax information firsthand from a professional team like Distinct Tax Consulting Group. DTCG strives to provide the expert information and assistance you need by pointing out the opportunities in tax law that will most benefit your specific situation.

At DTCG, our highly trained and experienced staff have the ability to keep track of your important business records with accuracy and great attention to detail. You’ll have the timely information you need to make important decisions at your fingertips.

LEARN MORE

SCOPE OF WORK

Tax Notice Response (Up to 2 included)

Reasonable Compensation Analysis

Quarterly Fixed Asset Depreciation

Quarterly QuickBooks Review

Tax Reduction Plan

Tax Projection

Tax Preparation (1 business and 1 Individual)

Tax Account Monitoring Quarterly Tax Deadline Reminders

Unlimited Email, Text, 15 & 30 Chat Support

LEARN MORE

FORMS/ SCHEDULES

1040-Individual Income Tax Return

State Income Tax Returns

1040X(Individual Amended Income Tax Return)

SCHEDULE A(Itemized Deductions)

Interest & Ordinary Dividends

SCHEDULE C/E (Profit or Loss From Business/Rental)

Schedule D (Capital Gain & Losses)

Form 1065-US Return of Partnership Income

Form 1120-Corporate Income Tax Return

Form 1120S-S Income Tax Return for an S Corporation

1065/1120/1120s Amended tax return

1041 Estate/Trust Return 990/990-PF Non Profit Return

990-N Non Profit Return Refund Transfer Fee

Re-Run Tax Return after return is complete Fee

Form 4868-6-Month Extension

IRS Transcripts (PER PULL)

Tax Notices (PER NOTICE)

Tax Audits

Hourly Consultations

LEARN MORE

SCOPE OF WORK

Monthly IRS Transcripts, notices, and audit monitoring

Monthly State business compliance monitoring with notifications

Annual Tax Projection

Accountant will advise on ways to maximize revenue and minimize expenses

Accountant will review financial statements and provide financial

Quarterly audio and/or video conference call with your Accountant

Financial Statement(s) including monthly profit and loss statements

Monthly Accounting Tasks and Monthly financial reviews

Record and review of all transactions and reconcile payroll entries

Reconcile payments and receipts to bank/credit card statements

Payroll Guidance and Assistance

Tired? Stressed? Overwhelmed?

Tired? Stressed? Overwhelmed?

Schedule a free strategy call with one of our tax planners and strategists, so we can help take the anxiety out of your tax burdens that come from business growth.

Schedule a free strategy call with one of our tax planners and strategists, so we can help take the anxiety out of your tax burdens that come from business growth.

Where are you coming up short?

Where are you coming up short?

LACK OF

TIME

LACK OF TIME

Do you spend hours online searching for tax saving ideas? Or do you just avoid it all together?

LIMITED AWARENESS

LIMITED AWARENESS

Concerned you may not be aware of all the eligible deductions that are a result in missed opportunities to reduce their taxable income?

INSUFFICIENT DOCUMENTATION

INSUFFICIENT DOCUMENTATION

Did you know lack of Record-keeping and documentation practices will result in missing deductions, tax credits, and exemptions during tax planning?

Do you spend hours online searching for tax saving ideas? Or do you just avoid it all together?

Concerned you may not be aware of all the eligible deductions that are a result in missed opportunities to reduce their taxable income?

Did you know lack of Record-keeping and documentation practices will result in missing deductions, tax credits, and exemptions during tax planning?

Subscribe to the Distinct Newsletter

Subscribe to the Distinct Newsletter

Hours of Operation

During Tax Season (January 1 - April 15)

Monday - Friday 9:00 AM - 5:00 PM

Saturday and Sunday - Closed

Post-Tax Season (April 16 - November 30)

Tuesday - Thursday 9:00 AM - 5:00 PM

Monday and Friday - Closed

Saturday and Sunday - Closed

Pre-Tax Season (December)

Appointment Only

CONTACT US

2024 © Distinct Tax Consulting Group, LLC

All Rights Reserved

Terms and Conditions | Privacy Policy

Hours of Operation

During Tax Season (January 1 - April 15)

Monday - Friday 9:00 AM - 5:00 PM

Saturday and Sunday - Closed

Post-Tax Season (April 16 - November 30)

Tuesday - Thursday 9:00 AM - 5:00 PM

Monday and Friday - Closed

Saturday and Sunday - Closed

Pre-Tax Season (December)

Appointment Only

CONTACT US